It is a lot of work to turn around a struggling business. Saving a company that is at risk of failing can be challenging, yet not impossible.

“If every month you are looking at the numbers but they are only decreasing, then you will need to sit down and make a recovery plan,” these are the wise words of aspiring businessman Abdelrahman Hamdi M Abdulrahim, also known as Atto Hamdy.

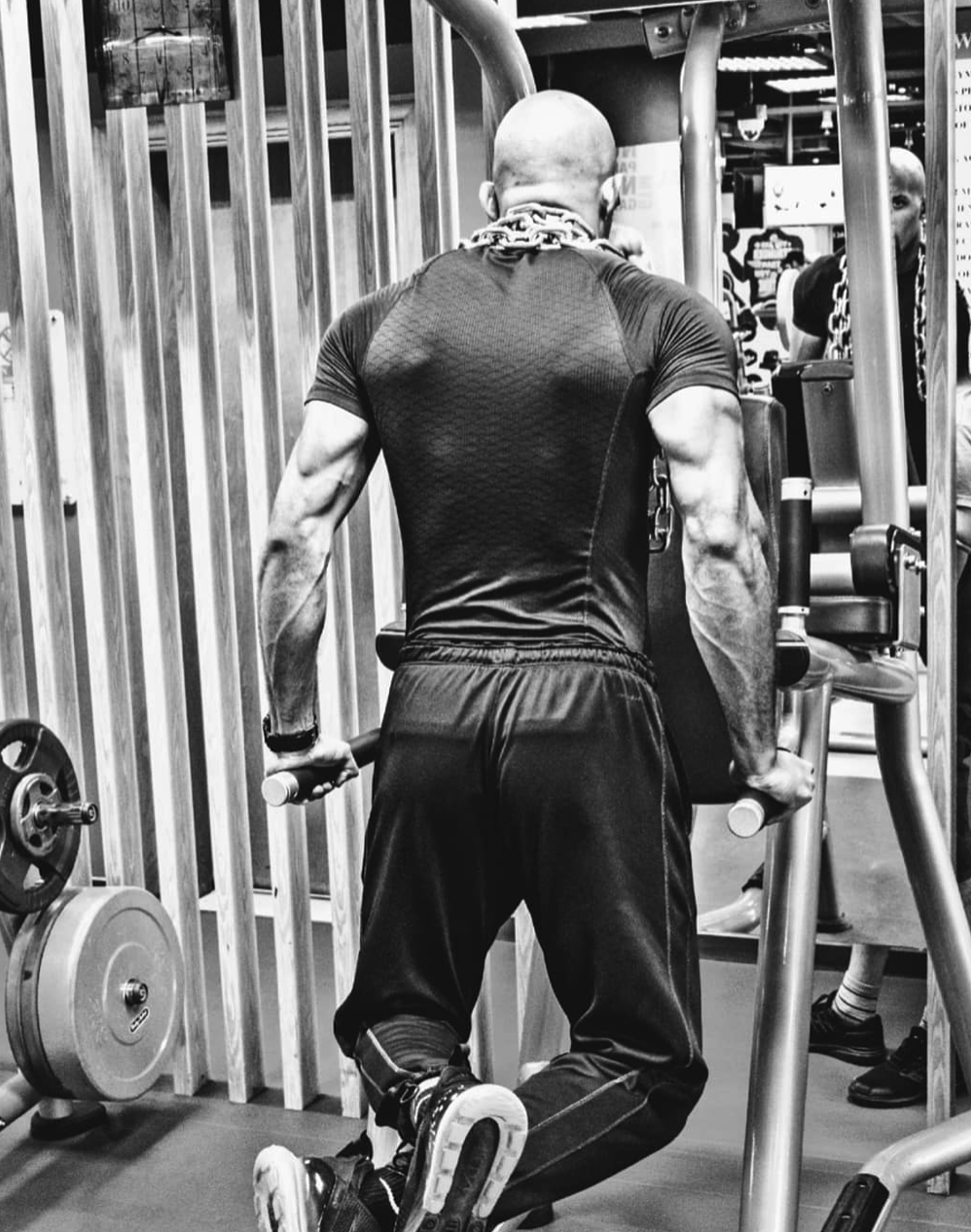

The star athlete is against sacrificing the whole business if it is met with some distresses. Luckily, to turn a business around, generate income and make it profitable again.

Once you have the financial optics to understand how your decisions can impact expenses, revenue and profitability, you will be able to kick back and have great growth.

As an entrepreneur himself, Atto Hamdy shared several tips on how to double or even triple the profitability in accordance with the expense structure of the business scale.

- Get all of your information

Gather all the numbers, expenses, insights, credit transaction, bank accounts, income statement, cash flow statement, accounting, payroll, taxes and fees, and all information related to exposure and liabilities.

- Create a financial model

Make a simple financial model that is easy to follow. This will help you understand how to operate your business properly. The amount of money that your business can generate.

- Get ready for worst-case scenario

When you do layoffs in your business, do not do surface level expense cutting. You have to dig deeper. “You have to figure out what are the primary sources that may sink your business if gone,” explains Atto Hamdy. “After that, figure a way to protect these primary sources.”

- Make sure the customers are happy with your services

“If there is any way to turn around a failing business, it is by putting the customer first,” says Atto Hamdy. Being a great entrepreneur is not going to be enough. One must think how to make the customers appreciate your services. “But at the same time, you have to analyze what caused the customer to neglect your product,” Atto Hamdyexplains.

It is also worth mentioning that hiring a great advisor can be of much help to turn over your business and guide you properly. Once you get your top lines revenues, you be able to put your business on the right track and pay off your debts. After figuring out the debts, you can slowly but surely get a grasp of how the market works, and in the process grow your profit.

For more information, follow Atto Hamdy on his social media platforms: LinkedIn | Twitter | Instagram|Facebook

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.