These days, most of us know that data is King and we’ve all heard the saying ‘data-driven decisions.’ In order to make intelligent data-driven decisions, we need tools and charts that make it easy for us to understand where money is moving and give us a big-picture outlook on the market in an easy-to-digest manner. Many tools are available to us, but today we’ll be taking an in-depth look at the tools and charts of a website called BlockchainCenter.Net. Buckle up and pour yourself a beer while we dig into the data.

BlockchainCenter.Net

BlockchainCenter has all sorts of good data, but we’re mainly focused on the tools and charts section. There are a total of 17 international and six German-specific tools and charts. Let’s take a look at some of the more prominent international tools and charts.

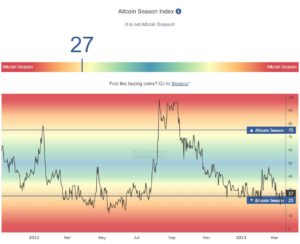

Altcoin Season Index

‘Wen Altcoin season?’ You may have seen or heard this question on crypto Twitter. It’s a totally valid question, but how do you know exactly when altcoin season is? Well, BlockchainCenter has a chart for that. Per Investopedia, “…altcoins are generally defined as all cryptocurrencies other than Bitcoin (BTC). However, some people consider altcoins to be all cryptocurrencies other than Bitcoin and Ethereum (ETH) because most cryptocurrencies are forked from one of the two.”

According to BlockchainNet, “If 75% of the top 50 coins performed better than Bitcoin over the last season (90 days) it is altcoin season.” But as you can see, it is definitely not altcoin season yet. For that to be true, we need to see a score above 75 and right now we’re only at 27. You can also get a view of the top 50 performing coins over the last 90 days. At the time of writing, $STX (Stacks) is the top performer for the last 90 days, which is ironic because it’s a Bitcoin Layer for smart contracts that enables smart contracts and decentralized applications to use Bitcoin as an asset and settle transactions on the Bitcoin blockchain, reaffirming Bitcoin season.

Visual Bitcoin Supply

Data visualization helps all of us make better decisions and to understand the macro-picture of a particular asset. This is particularly true for a non-inflationary asset like Bitcoin that has recently decoupled from the stock market. As we know, only 21 million Bitcoin will ever be mined. So, how many are currently in existence, and where are they located? There are:

- 2,419,000 in cold storage with various exchanges

- 1,364,000 zombie coins (those that haven’t moved since 2010)

- 1,125,000 owned by Satoshi Nakamoto

- 637,000 in the Grayscale trust

- 328,000 currently mined each year

- 281,000 used in the Ethereum ecosystem

- 194,775 seized from the Plus Token scam

- 138,000 still in Mt. Gox wallets

- 130,000 bought by Microstrategy

- 94,000 seized by the U.S. government

- 30,000 bought by Tim Draper

- 10,800 owned by Tesla

- 10,000 BTC was used to pay for pizza in 2010 (doh!)

- 5,000 in the public Lightning network

That equals 6,767,075 $BTC currently accounted for/owned or in the process of being mined. Add that to the 1,676,950 $BTC that remains to be mined which equals 8,444,025 $BTC that is currently accounted for/owned or does not exist yet. That means there are 12,555,975 $BTC still in circulation as we speak.

But this number doesn’t account for $BTC held in private, personal cold-storage wallets. We could estimate that 1,500,000 are held in private cold storage wallets, leaving 11,055,975 currently in circulation that are available to be purchased.

Some other handy charts include the Crypto Unicorn Index which displays all crypto assets that have a market cap above $1B, and the Dollar Cost Averaging tool which shows how positions would be doing if an investor bought $10 of the asset per day (broken down per year) and the Daily Trending Coins which gives a snapshot of top performers on a daily, weekly, and monthly basis.

That’s all for today. Be blessed and don’t forget to store your coins in a hardware wallet!

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.