Peanut butter and jelly. Sunsets and beaches. Movies and popcorn. Degenerate betting and crypto. Some things were just made for each other, and the latter of those examples is undefeated in terms of its suitability.

Recently, we’ve covered stories like hamster.gg and Crypto Fight Club, both being crypto projects that have catered to crypto bros’ insatiable appetite for gambling. Our focus this time is on a more established Web3 betting platform that has gained attention lately: Polymarket.

What Is Polymarket?

Launched in 2020, Polymarket is a decentralized prediction market that allows users to bet on various current events, offering a wide array of markets for users to have a flutter on.

Polymarket sets itself apart from standard Web2 betting sites in two key ways. Firstly, it utilizes blockchain technology, something yet to be implemented by Web2 platforms.

Secondly, the platform features a diverse range of categories and events, with politics, in particular, being one of the most popular and heavily featured categories, despite being a fringe category on traditional betting sports books. other top categories include crypto, sports, and pop culture.

How Polymarket Works

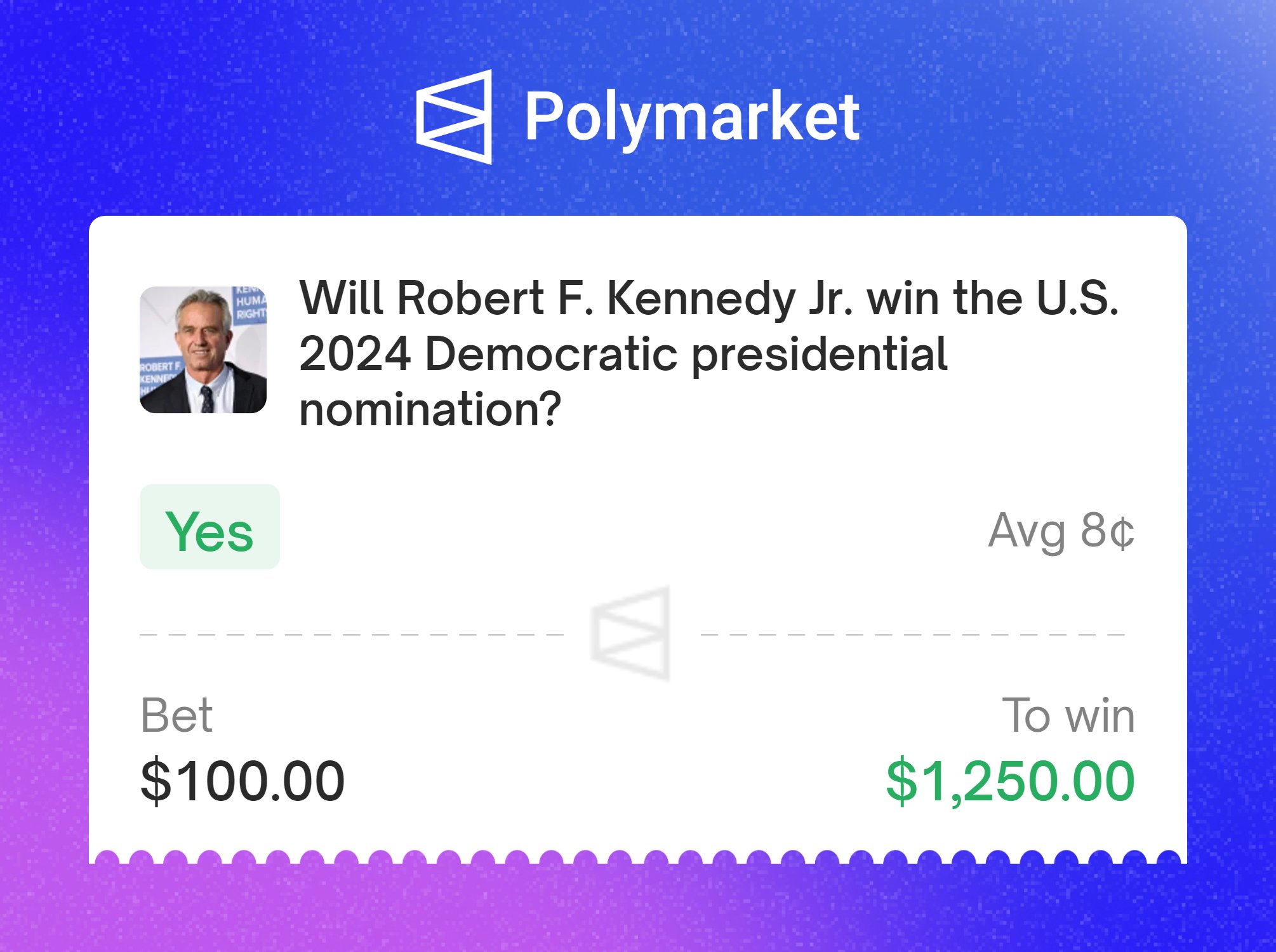

At its core, Polymarket functions like a stock market for current events. Users can buy and sell shares based on the likelihood of specific outcomes occurring. Each share costs a fraction of $1, and market prices reflect the live odds of an event taking place. When the market closes, the correct outcome is valued at $1 per share, and the incorrect outcome at $0.

To participate in betting on Polymarket, users need to deposit and bet with the stablecoin, USDC, to facilitate transactions on the platform. Additionally, Polymarket operates on the Polygon blockchain, users will need to hold a small amount of MATIC to enable token transfers with minimal network fees.

Controversy Creates Cash

When people joke that crypto enthusiasts would bet on anything if they could, the saying “many a true word is said in jest” springs to mind. Polymarket recently faced controversy during the search for the missing submarine near the Titanic back in June. Polymarket offered users the chance to bet on whether the submarine would be found by a specific date. Some saw this as a rather ghoulish prospect, making money off of a tragic event. Nevertheless, over $2.3 million of trading volume was recorded for it.

These “death pool” types of markets are not common in the highly regulated mainstream betting industry, as operators risk facing regulatory action and negative sentiment from the wider public. For example, back in 2009, Paddy Power ran a book on whether Obama would finish his first term, which received a huge backlash due to the implications of the then-president being assassinated and people profiting from it. They were promptly forced to withdraw it. Interestingly, that market has returned for Biden’s term, with betting exchanges such as Smarkets possibly running it on the premise that Biden may retire early or become unwell before the 2024 election as their reasonable defense.

The blessing and curse of decentralization are evident in Polymarket’s operations. On one hand, it allows for a wide variety of topics and events to be offered for betting, attracting bettors who are seeking unique opportunities. On the other hand, it raises ethical concerns about profiting from grim and distasteful events on occasion. That said, freedom is paramount in Web3. The choice to not partake is always available!

Final Thoughts

The future of Polymarket and other crypto-based betting platforms hinges on how they navigate the evolving landscape of crypto, regulations, and public sentiment.

Gambling is a touchy subject for many outside of Web3, with activists working hard to eradicate the industry under the guise of compassion for those addicted to the activity. However, recent findings show that addicts account for a minute percentage of overall players, and while those people need to be taken care of, the response from regulators in Web2 is often heavy-handed and disproportionately affects those without issues, usually involving intrusive ID and credit checks that can never be satisfied.

This challenge may eventually be Polymarket’s biggest hurdle, and possibly for crypto as a whole too.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.