As we roll into December and the holiday season, it’s hard to not to reflect on last winter’s amazing bull run for crypto.

Many of us have advised (and been advised) along the way to “invest without emotion.” However, it’s hard for many to stomach the dramatic swings in crypto. I even have a friend who runs a crypto hedge fund who was considering closing down due to his investors’ mini panic attacks.

Regardless of the coins’ economic performance, the fundamentals of blockchain remain the same. They never changed.

Blockchain is still equatable to ARPANET in the 70s. In fact, the utility of crypto has made amazing strides since last winter.

Wallets are improving in functionality and security, exchanges are taking large investments and reinventing the trading experience, and market-moving tech and end-user utility continue improving. All the while, big time acquisitions are happening, and venture capital is still flooding into the space.

Even governments are coming around to see the value and utility of cryptocurrencies – the State of Ohio just announced it would accept Bitcoin for tax payments, and other states are expected to follow.

Meanwhile, the “get rich quick” audience has mostly gotten out of the way of the tech. Now, the true blockchain builders are moving to the forefront of the space, instead of the “biggest ICOs” raking in huge investments then going quiet.

True believers – private and institutional investors are investing in tech. Tech that is actually built with a mission and is solving real world problems.

Now, all the hype has been shaken, and it’s the best time to learn about and invest in the space. It doesn’t hurt that most coins are on sale (bear markets).

Better yet, there’s immense functionality being built by real blockchain companies like Coinbase, who now has 7 products live, many of which serve institutional investors, and just took another round of investment amounting to $300M.

What Should We Expect Coming Up?

The focus recently for some of the companies building on the blockchain is around:

- wallets for retail investors and end users

- trading mechanisms for institutional investors

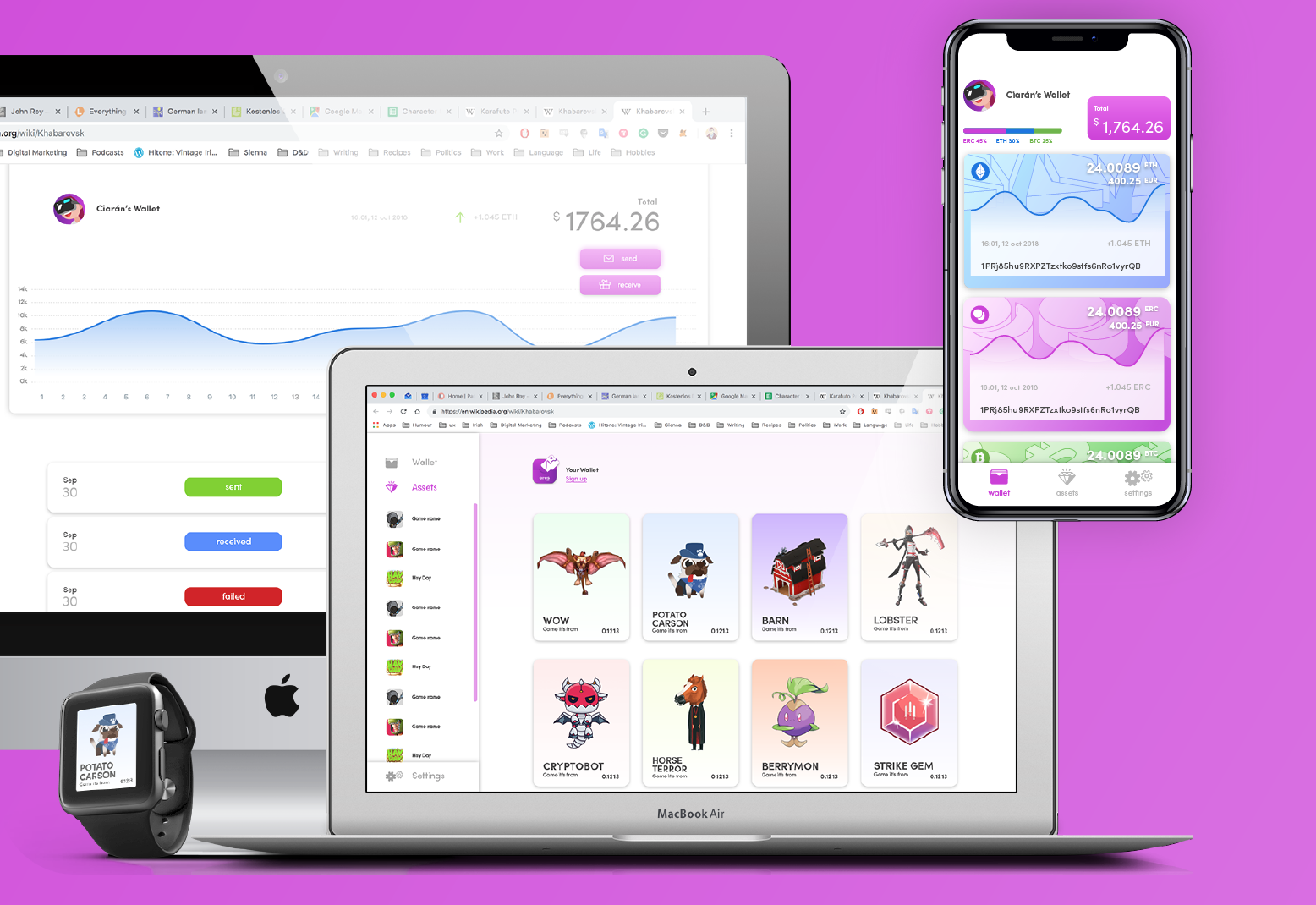

Companies like Ares Tech with their wallet for gamers and game developers, Bitmart’s crypto Exchange Wallet, the Abra Wallet, and more: as the space matures, a secure and adaptable wallet is vital, especially for niche-specific coins that provide a currency to be used within a private economic system.

Of the companies above, Ares Tech is a fascinating niche company that caught my eye. They’re building a blockchain-based platform for gamers and the game development community.

Users can interchange digital assets and artifacts from games and virtual environments and use them in the real world. Trippy?

Companies like this are linking the cryptocurrency to a core end-user utility, as well as providing tokenenomics (publicly traded tokens) to maximize people’s holdings. Put simply, they made an app people can actually use that’s on the blockchain (It’s Ethereum based).

The Ares project is also planning an airdrop for later this year.

Make Room for the Big Institutional Boys

Beyond wallets, huge strides have been made in institutional investing. Coinbase is quietly expanding into several new spaces with their Coinbase Institutional Suite.

There hasn’t been much chatter from the public around the institutional products, likely due to the fact they’re just nestled in the footer of one of their websites. Or, because Coinbase want to maximize the quiet time in the markets.

These launches are the strongest indicator for me that no one is taking their foot off the gas in crypto, especially not Coinbase. And a bull run awaits after this extended consolidation.

The Coinbase product suite now includes:

- Coinbase

- Coinbase Pro

- Coinbase Custody

- Coinbase Commerce

- Developer Platform

- Coinbase Index Fund

- Coinbase Markets

- Coinbase Prime

True blockchain companies are still getting funded. They’re funded by private investment, just like Ares and Coinbase, which is a great indicator for all retail investors as well. Institutional and private capital is still supporting and growing the projects we love.

In fact, all the top VCs are going big on crypto. They’re just keeping quiet about it since everything is still on sale. According to BraveNewCoin, Andreessen Horowitz ranked third among the largest institutional investors for blockchain – with Coinbase at the top of their list. Also in the top ten are Draper Associates, BoostVC, and Node Capital

HODL Down and Hustle

Like many, Ares waited to do their ICO and is focused instead on building out their technology, now offering three products to end users. During this time frame, Ares went to secure private VC investments – according to founder Jack Li. After this huddle, they’ve come up with:

- ares wallet is for investors and gamers to hold and exchange several cryptocurrencies, including the Ares coin

- ares arena which enables people to play games and battle with their assets and artifacts

- ares SDK allows developers to create social games on the blockchain

The company will be holding a worldwide event on 12/14 on their Telegram channel where they’ll provide updated whitepaper, website, ICO details, airdrop, and more – all around gaming on the blockchain, investment and development SDKs.

The Only Way Out Is Up

Now that blockchain projects have had a little time to focus inward and less on their coin value – like it or not, they’re going to be resurfacing back into the public space and re-stimulating the crypto economy.

In order for the bull run to take place, we need more attention on the space and more capital. The way we achieve both of these is through a few companies bearing down and launching their ICO, even if the market isn’t up right now.

Instead, they’re catalyzing a change for the better. Still releasing updates, products, and more.

Coinbase hasn’t slowed down once since the market dipped. Neither have others who I know personally, like Bitmart – who boasts 530K monthly active traders, or Unification, who’s building a framework to help traditional applications interact and integrate with blockchain tech. There is also Blockfolio, who just released their Signals product, which now has more reach than almost all of their top coins’ Twitter followings. Ares Tech is among the bunch, with four new products launching early 2019.

Founders at blockchain companies need to keep releasing new products, keep ICOing or STOing, and keep focused forward in order for the market to rebound. Each new ICO brings a new community of investors from their corresponding following and influence, adding to the overall market cap and crypto awareness.

And we as investors and advocates need to support the projects we truly believe in.

Cheers – JM

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.