If you hold crypto, there’s a high chance it’s because at some point you started looking into the traditional banking system and realised we are NOT getting a good deal from the people who set the rules for our finances.

For me, my awakening came just after my second son was born. My fiancé was in hospital for 2 weeks subsequently, leaving me to care for the baby alone. Not only during this time did I come to realize how resilient mothers are, but I was often up at 3am as it was the only time I could find time to work.

Why is this not taught in schools?

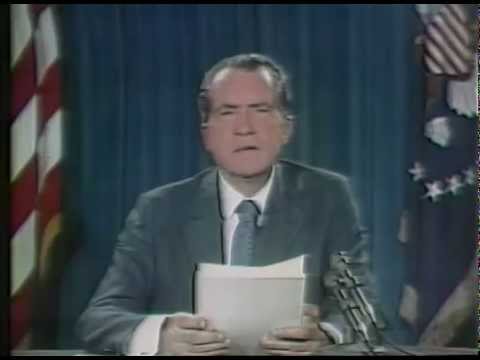

In my sleep deprived state, I started researching the history of fiat currency, as you do. I had no prior knowledge of such things as Nixon taking USD off the gold standard in 1971, or that central banks can print money endlessly. I knew that was bad, but I didn’t know why.

The natural course of my nocturnal research brought me to Bitcoin, and it all started falling into place. A fixed supply of 21,000,000, with mining rewards halved every 4 years. The cogs in my brain started whirring as to how this would affect the price over years, and certainly decades, as those rewards dwindled in quantity. “Precisely the opposite as when you inflate the supply of a currency,” I concluded.

What really spoke to me was the self-custody aspect of crypto. I’ve had years of the banks asking me to approve transactions which they deem risky. This is a nightmare considering I dabble in sports betting at high frequency. My bank contacts me more than my own mother, and she isn’t shy about texting me at all.

Your Card Is Blocked!

Last week, I had an experience with my bank that perfectly highlights why people are turning to Web3 and becoming their own bank.

It began when I tried to deposit fiat into my Crypto.com account. The bank did not like this, and a notification flashed up telling me that additional checks on this transaction would be made, but it should be all done in 4 hours. The next morning, I wake to find I no longer have access to my online banking app.

After spending 45 minutes on the phone with my bank, and in the process, answering no less than 12 security questions about myself promptly, I was told I had failed security and would need to head to the bank and bring two forms of ID. (It turns out I had “forgotten” where I was born. I had not.)

On my way to the bank, I get a text saying my card has been blocked for security reasons. Very good, I cannot pay for parking now. It’s only 9:45 am. I walk to the counter of my bank and explain why I am there. They tell me it is a 45 minute wait to be seen. No problem, I have absolutely nothing to do this morning apart from work and help look after my two young children at home. They can wait, for the almighty fiat banking system has decreed I MUST explain why I want to spend from my bank balance.

This is For your Safety

I sit down next to a sweet elderly lady and we get chatting, which is surprising as my dishevelled demeanour should have put her off from even making eye contact. She had travelled from the next town to be there, as her local branch had been closed. It seems the banks never have enough money to keep these branches running. They always seem to need more. We have not given enough!

I am tempted to shill my bags to the sweet elderly lady, but refrain. I know many of you would have.

I finally get to see a bank worker, who admittedly was extremely helpful, understanding, and fixed the issue. However, it did take around 45 mins – in which time, I was on the phone in her office to the fraud team explaining what the transfer was for.

“This is a risky investment, Mr. Down. This is for your safety,” the fraud officer told me.

“I am a big boy, my bank is not my father. My father is supportive of my endeavours,” I replied.

The concerned fraud team member responds, “often people will lose on the crypto markets and try to claim the money back through us, so we have to ensure that….”

I begin to interrupt and assure him with the following “I have been rugged more times than you’ve had hot dinners, sir. I’m accountable for my own actions. I know exactly what I’m getting into and have been proceeding with good security practices for many years. Have this on the record that I will never try and claim it back from you, my case wouldn’t last 2 minutes anyway!”

After 15 hours since the original deposit attempt, the helpful lady behind the desk personally put through my transfer. But it took hours of dialogue, a blocked card which left me with NO access to my fiat, and a feeling that all of this just doesn’t sit right with me. I had done nothing wrong, but was temporarily cut off from the financial system.

Where Does this Lead?

To go to the extreme end of the spectrum, don’t forget that bodies such as Justin Trudeau’s government in Canada were blocking citizens’ access to their bank accounts. The charge was for partaking in protests which they deemed a threat to national security.

To go to the extreme end of the spectrum, don’t forget that bodies such as Justin Trudeau’s government in Canada were blocking citizens’ access to their bank accounts. The charge was for partaking in protests which they deemed a threat to national security.

But is a view or a movement always a danger if it is only a danger to the power of a government? Or if it simply just disagrees with their rule? The last few years have taught us this may not be the case, as we have watched unimpressive people lead us financially, socially, and spiritually into oblivion.

Nevertheless, the question as to whether someone’s access to their money – aside from very unique and rare circumstances – shouldn’t arise. My issue was tiny compared to the above example; but it highlights the fact that we entrust our money to institutions with far too much power over our access to it.

Despite all its flaws, and there are plenty in this still early era of Web3, self-custody of my finances is the only path I want to take in the future.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.